More than two years on from the country shutting down all legal gambling for two months, what is the current state of the Latvian market? iGB talks to TonyBet Latvia and Estonia country manager Valters Rozmanis to find out more.

It’s one of those thought experiments that naturally comes up from time to time in this industry – what would happen if a country just abolished gambling overnight?

How would consumers adjust? Would they abstain entirely or move in droves to the unregulated black market, outside the remit of both the taxman and a socially responsible regulator?

Latvia provides something of a natural experiment in this regard. In April 2020, as the first wave of Covid-19 lockdown measures were announced, fearing for the wellbeing of their citizens, the 40th government of Latvia announced a complete ban on all forms of online and land-based gambling.

The shutdown, which ran from 6 April to 9 June, pitted a modern, digital-savvy European country against the mawing forces of the black market. Against the resourcefulness and ingenuity of black-market operators, the country’s Lotteries and Gambling Supervisory Authority, was armed only with the ability to block IP addresses and efforts to educate the public.

Worse than the disease

In this case the government found that the remedy was worse than the disease. Despite the good intentions of the Latvian government, the principal result of its actions has been that, more than two years since the return of gambling to Latvia, the country has the largest black-market market share of any fully regulated market in Europe. According to data provided by the European Gambling and Betting Association, illegal operators have a 45% market share in Latvia, as opposed to the European average of 20%.

The situation is a morbid reminder that you can’t unburn the toast. Once consumers abandon the regulated market for the dubious waters of illegal offerings, there’s no switch that can be turned on to bring them back overnight. Educating consumers and playing whack-a-mole with black market sites becomes the work of years.

“The Covid-19 pandemic was an uncharted territory for all of us,” says TonyBet country manager for Estonia and Latvia, Valters Rozmanis. “We are entering the market with hope that these kinds of situations will be properly analysed before moving to such decisions.”

Adding to the difficulty is the stringency of the regulatory regime. Under current Latvian law, all withdrawals above €3,000 are automatically classified as winnings and taxed at 23%, no matter the individual losses that a consumer may have experienced with their stake. With many customers having tried the black market, it’s tough to bring them back to that system.

“I believe this system forces bigger players to find ways to play in other, non-locally licensed entities,” says Rozmanis. “For me it is hard to justify the situation where a losing customer is withdrawing money and forced to pay additional tax. We are trying to open discussions about this law; hopefully it will be changed in the future.”

But in the wake of past disastrous experiments in policy, what is the current state of the Latvian market?

State of the nation

Rozmanis argues that while the market indeed has unique characteristics, in essence it is not so different from other geographies.

“The Latvian market is a slot-heavy market, casino being 80% of total GGR,” said Rozmanis. “If we speak about sportsbook, the second-biggest product, then definitely ice hockey plays a major role, which can be different from the majority of the markets.

“Nevertheless, we are not so different; the same rules also apply here. Everyone will have their eyes on the Fifa World Cup in Q4 – Latvians won’t be an exception here.”

Rozmanis said that he expects the market to maintain slow but steady growth in the years ahead.

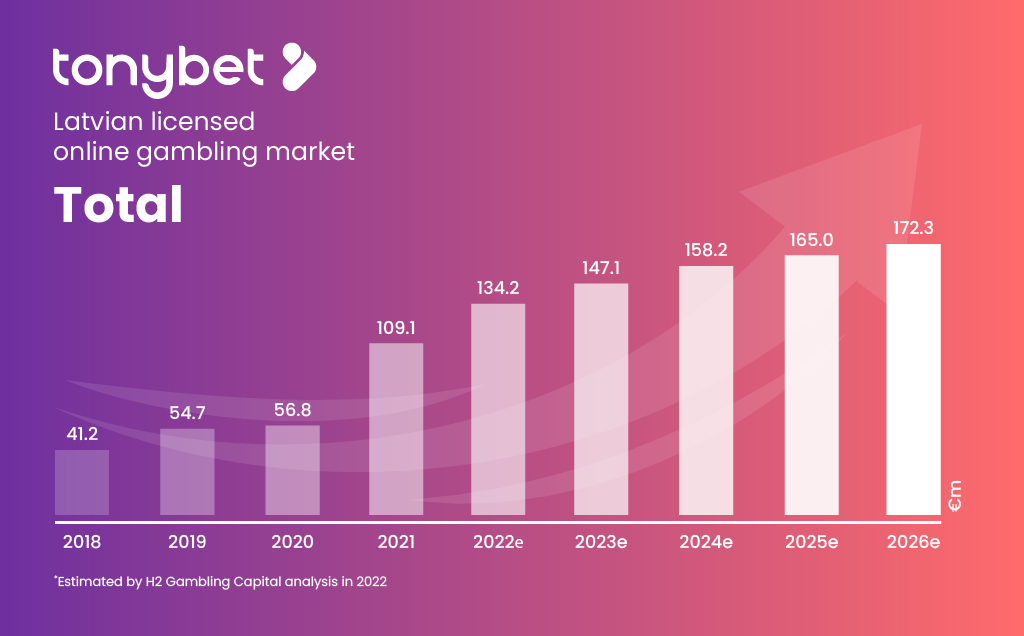

“The Latvian licensed online betting and gaming market generated €109m of gross win in 2021, having grown at a three-year compound annual growth rate from 2018 to 2021 of 26%. We see that the clear acceleration was in 2021, when the market grew by 92% year on year, however this was in part due to a lower 2020 base where the market was closed for two months,” he said.

“There was a market analysis done this year by H2 Gambling Capital about the Latvian market. According to their predictions and what we see in the market, it is presumed to have a lower, but steady, level of growth in Latvia with the market forecast to achieve gross win of €172m in 2026, growing at a five-year compound annual growth rate from 2021 to 2026 of 10%.”

Dark clouds

TonyBet is a small operator, which only entered the market in September. While regulatory conditions, as mentioned, have deterred many operators from dipping their toes in the water, Entain has given it a go through its 2021 acquisition of Enlabs – instantly giving it a plum share of the market.

“No doubt, Enlabs is a major force in the market, at around 50% of total licensed online market share,” said Rozmanis. “In Latvia, smaller players need to use their flexibility in decision making in terms of product promotions to compete efficiently.”

However, Latvia is no island. In 2022, Central and Eastern Europe has found itself in the geopolitical cross-hairs, as the ongoing war, recession and energy shocks rock the new democracy. Rozmanis advises that these factors must be taken into account when considering the Latvian market.

“Considering the recent geopolitical events in the eastern side of Europe, inflation rates and recession I wouldn’t want to play a role of Nostradamus here,” he says. “There are certain events that can impact the market trends, let’s put it that way.”